Know Your Customer (KYC) is the process which helps businesses identify & verify the details of their clients. This is one area that APIs are already having a substantial impact. These APIs are mostly used by banks and companies to ensure anti-corruption compliance and to verify the identity of their customers or agents. “Currently more than 200 KYC API’s available under API Setu Portal“. As a note APIs provided on API Setu are open for access but require approval from the principal departments of each respective API. however APIs can be accessible via consent mechanism process through #DIGILOCKER Authorized partner route.

This is two-way API integration will help clients seamlessly run the products and services using our powerful backend. Rather than build and integrate hundreds of interactions, our two-way Rest API enables real-time two-way communication and simplifies the development process without a complex integration mechanism.

Let’s Discuss Benefits of KYC verification with APIs integration:

- Credit risk profiling : KYC is a key component for risk profiling in fintech. Use our services to build a strong risk profile of your customer.

- Sleek and agile onboarding : Redesign your KYC processes to incorporate digitization and automation. We help you perform due diligence exercise.

- Secure shared economy : Shared economy is based on security and trust. Verify the partners on your platform to build trust among your customers.

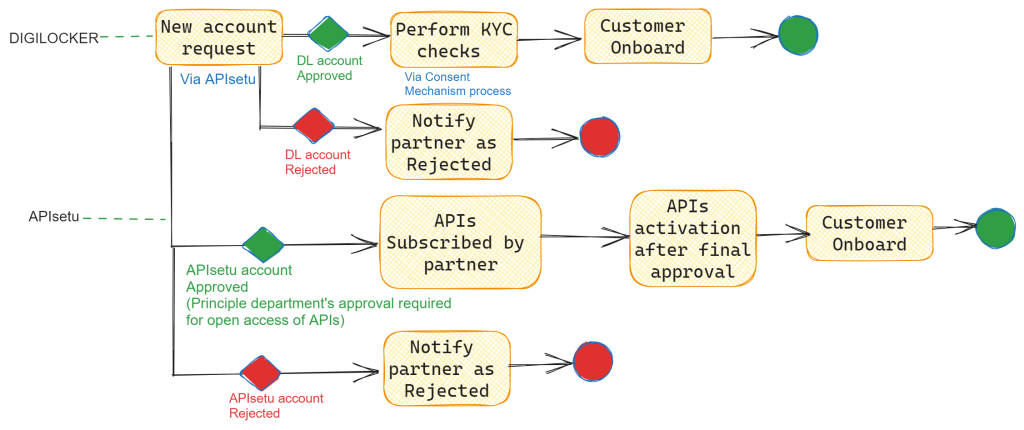

Flow diagram of KYC process with DIGILOCKER Auth. Partner Route/APISetu :

Most demanding KYC APIs Available under API Setu platform :

#PAN Card : Income Tax Department, Govt of India has provided #PAN Verification Records to Indian citizens. You can verify the correctness of your PAN data in real-time using this KYC facility.

#Driving License : #Driving License (DL) as issued by Transport Department, where You can verify the correctness of your DL data in real-time using this KYC facility.

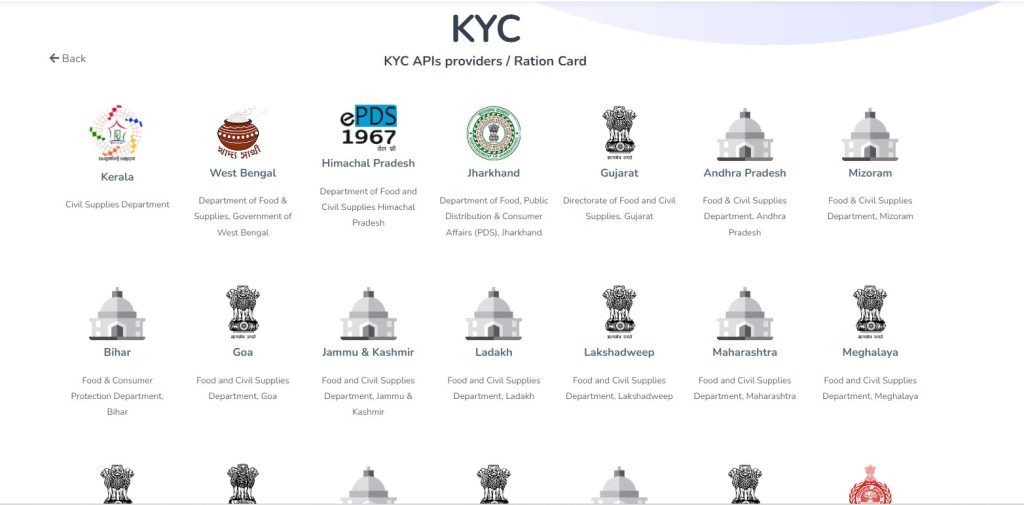

#Ration Card: #Ration Card details of Food, Civil Supplies and Consumer Affairs Department’s Portal RCMS (Ration Card Management System) can be pulled by citizens into their Digi Locker accounts.

Some of the #Driving License / #Ration card APIs under #APISetu mentioned below:

#Know Your Customer (KYC) combines thorough initial work and ongoing due diligence to hopefully decrease financial institutions’ risk to illegal activities and fraud digitally. The more information we can gather from our customers, and feel confident about their true identity, the better able we are to anticipate risk and catch suspicious activity – before it causes significant damage..

References:

>> https://apisetu.gov.in/

>>https://tallyfy.com/know-your-customer-kyc/